The challenge – Change how people pay each other

Create a new way for young, social people to share money across Europe, in a world where private payments are still slow and complicated.

The process - From zero to launch in six months

Back in 2016 a team of experienced FinTech engineers, product managers and designers built a peer-to-peer payment product called Cookies (see more details on this project here). After internal issues deadlocked the launch of the Cookies app, the team was approached by Swedish e-commerce payment giant Klarna Bank AB. Cookies eventually became a member of the Klarna family in November 2016. A few people joined to create the team of then 14 people, and together we faced a new challenge later called the Wavy app.

From our previous experience, we already had in-depth knowledge of the user groups, their needs, and problems. This allowed us to jump right into the ideation phase by the beginning of 2017. The goal was to go live with a minimum viable product asap, to test the product with real users and real tracking data.

While the developers started off with building the backend infrastructure we (Wavy team lead, head of product, UX/UI designer, product marketing and me) kicked of the first ideation phase for the core functionalities. It included defining our value proposition, creating personas, holding prototyping sessions in co-creation with the developers, fine-tuning the designs and filling the backlog with user stories and feature requirements. We chose to skip testing the prototypes with real users and jumped right into implementation. An agile scrum based setup allowed ideation and development to happen simultaneously. The phase was closed by a company-wide beta phase, which I was in charge of, including our first in-house usability test to kill the most significant bugs and usability issues.

Only six months later, in August 2017, we launched the Wavy iOS and Android app. As already at Cookies, we had laid a strong focus on user experience and emotional design as well as features that would offer real value to the users.

After the launch, the product was continuously improved with insights from various usability tests and user feedback. The app was extended by a fully autonomous web app, for which I was the responsible product manager in spring 2018.

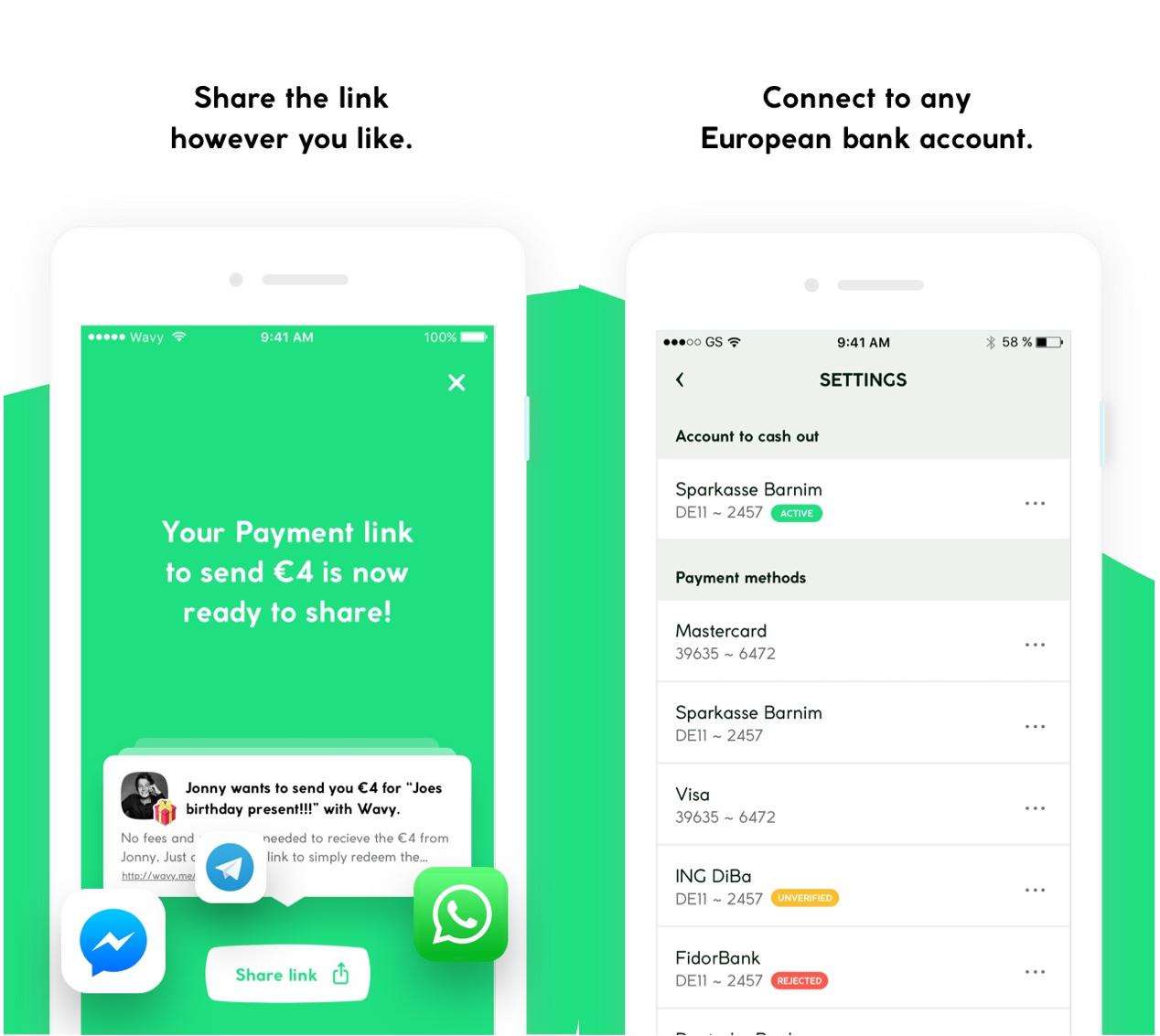

The product - Autonomous iOS, Android and web app

My responsibilities - Feature ideation and user research

During my time at Wavy, we were at the max. 15 people, of which the head of product, UX/UI designer, product marketing and me were responsible for the overall product roadmap, defining the features and gathering user feedback. We all together launched the MVP in summer 2017. After the launch, we took the time to develop clear responsibilities further. So that later on, I was the responsible product manager for the web app with a team of two developers and support from the design and backend team. I also led the user experience research for the whole product and the product related user communication.

In contrast to my previous position as a quality manager at Cookies, this position was focusing on creating product features instead of testing them before they launch.

My highlights - Steep learning curve and an outstanding team

The intense user research has left me with many insights in the user needs and problems when it comes to private payments. Also being acquired as a little start-up team by a big company was an experience that has left its impact. Not to mention the many learnings from not only ideating but really launching and maintaining a product in a fast-paced fintech startup set up. In summary, I can say my learning curve was steep, and there is a long list of experiences I was lucky to make, but I am afraid many of them are also confidential.

In the end, the biggest learning I take with me is that among all processes, methods, and knowledge- the most powerful tool you can have is a great team of really outstanding people with an here to help attitude.

Curious for more?

Take a look at the Wavy website and some articles from TechCrunch and Handelsblatt.